HUGO VAN DER MOLEN'S

Scripophily site

a collection of historic bonds

and shares

Scams / Schwindlerpapiere /

Schandalen

(update: 27-10-2024)

Dr. Hugo H. van der Molen -

Wederikweg 114 - 9753 AE Haren, The Netherlands

Tel: +31 (0)50 534 8795; email: [email protected]

en Facebook of Linkedin

See

page on explanations, sales conditions, costs of shipping and on how

to

order and to pay.

You are here: home - scripophily

- scams

en Facebook of Linkedin

Canada

Equicorp Industries Ltd.

Toronto, Ontario, Canada

1974, brown, x (=100) common shares in the name of Blanchard Nederland B.V., price 50 €.

On June 10th 1974 the Limited became an Incorporated as legal form, a statement of which is printed at the bottom of the certificate above.

Equicorp Industries Inc.

Toronto, Ontario, Canada

Vignette of elegant lady.

---------- brown, x (= 150) common shares, 1976, in the name of Blanchard

Nederland B.V, Signed on the back by mr. G. Jacobson, director of Blanchard Nederland, stockbrokers in Rotterdam.price 25 €.

---------- red, x (=200) shares, 1977, in the name of Blanchard Nederland B.V., price 25 €. (12.50 € for a certificate from 1976 with some minor border wrinkles).

---------- Equicorp cover-folder to hold shares, with photo of Toronto

skyscrapers, price 50 €..

The folder shows the Toronto city skyline on the front and other real estate and industry projects inside. On the back many graphs of Canada's booming economy.

These shares, together with those of QCI Industries

and Mircan Industries, were being sold at people's doors in The Netherlands in the 70-ies.

It appears that it all became a great scam. Read more about it !

Investors Overseas Services - IOS,

Incorporated under the laws of Canada,

Curacao depositary receipt to bearer, title

of

10 depositary shares, each representing 1 share of common stock,

Curacao, Dutch Antilles, 1969, green border on grey field, white

imprinted control seal and black printed tax seal, coupon sheet;

engraving: De Bussy Ellerman Harms, Amsterdam; EF, 14 Euro.

Het beleggingsimperium van Bernie Cornfield spatte als

een zeepbel uitelkaar en veroorzaakte een groot schandaal.

IOS was the infamous mutual fund of Bernie Cornfield,

that ended in a scam.

IOS-Investors Overseas Services,

Toronto, Canada, 1970, bearer share warrants

for a varying number of shares, with facsimile signature of president

Bernie Cornfield, vignette: lady

with bare breasts, long hair waving in the wind, holding Hermes staff (caduceus), sitting in front of a

harbour and factories, leaning on a globe, withh couponsheet attached,:

IOS was the infamous mutual fund of Bernie

Cornfield, that ended in a scam: many persons lost most or all of their

invested money.

---------- warrant for odd shares, dark brown border, no coupons,75

Euro.

---------- warrant for 1 share, brown border, 1969, VF+: 75

Euro.

---------- warrant for 10 shares, green border, 1969, EF, price

75 Euro; VF, with minor faults in upper border: price 55 Euro.

---------- warrant for 50 shares, dark grey border, 1969, EF,

price 75 Euro.

---------- warrant for 100 shares, purple border, 1970, EF, price 75

Euro.

Mircan Industries Ltd.

Ontario, Canada; engraving of graceful woman, similar to Equicorp Industries, share number printed over the engraving.

------ certificate of X Common shares , 1977, blue border, condition UNC: printer fresh, price 50 €.

----- certificate of X Preference shares, 1976, brown border, condition UNC: printer fresh, price 15 €.

These certificates were sold in The Netherlands and Belgium in the

1970's, together with certificates of Equicorp Industries and QCI Industries, at people's doors and through banks and brokers. It ended in a big scam. Read the story on Equicorp Industries !

QCI Industries Ltd, formerly Quinte-Canlin Ltd

1975, orange, x shares, vignette

of strong semi-nude man turning the wheel of fortune, The certificate is originally printed as a Quinte-Canlin piece, but later over printed in red with the text "QCI-industries, formerly" price 50 Euro.

QCI Industries Ltd

1977, orange, x shares,

vignette

of strong semi-nude man turning the wheel of fortune, price 25 €.

These certificates were sold in The Netherlands and Belgium in the

1970's, together with certificates of Equicorp Industries and Mircan Industries Ltd, at people's doors and through banks and brokers. It ended in a big scam. Read the story on Equicorp Industries !

|

Costa Rica

<---- click on picture for large scan

|

|

Capital Growth Company S.A.,

Certificates (ca. 20 x 30 cm) of preferred shares with a

3 by 6 cm Vignette in gold relief print of

a 3-master sail ship.

This investment company may be the successor of Capital

Growth Fund, registered in the Bahamas under New

providence Securities Ltd.

In 1974, the SEC (Securities and Exchange Commission) has filed a complaint against Capital Growth Company, its president Mc alpin and against related persons and companies for a sries of self-dealing transactions, resulting in depletion of the company assets (see SEC News Digest, Sept. 4, 1974).

I sometimes receive questions of persons who inherited or bought shares in

this company and want to know if they still have any economic value.

I don't think they have and that mr. Mc. Alpin, who signed the certificates as president, has deceived his investors.

Anyone who knows more about this company is requested to inform me, in order that that I

can answer those who wrote to me. See

our separate page for more information on this company and related ones. I take it that these certificates are now just collector's items, especially because of their beautiful sailship, printed in gold relief.

The following certificates are for sale as collectors items, all in unfolded and perfect condition. They all have the golden vignette; only the border colour and number of shares differ. Price differences reflect availability.

------- 1 share, green, July 19th1971, price 20 Euro

------- 5 shares, ocre, July 19th 1971. price 25 Euro

------- 10 shares, brown, July 19th 1971, price 25 Euro

------- 25 shares, blue, July 19th 1971, price 25

Euro

----- 100 shares, purple, July 19th 1971, sold out

France

Compagnie Universelle du Canal Interocéanique de Panama,

S.A. au Capital de 300 millions de Francs

et

Societé Civile d'Amortissement des obligations du Canal de

Panama Émission de Mars 1888, avec responsabilité

limitée à la mise sociale

Compagnie Universelle du Canal Interocéanique de Panama,

S.A. au Capital de 300 millions de Francs

et

Societé Civile d'Amortissement des obligations du Canal de

Panama Émission de Mars 1888, avec responsabilité

limitée à la mise sociale

(with facsimile signature of Ferdinant de Lesseps, famous builder of

the Suez Canal. in Egypt).

---------- Paris, le 14 Mars 1888; Obligation

Nouvelle au porteur Remboursable à Mille Francs dans une

Emission de 350.000 obligations, authorisée par

l'Assemblée Général du 29 Juillet 1985; size

19 by 14 cm., same engraving as above by Stern in Paris, brown, red

stamp from the liquidator, red stamp or print indicating that this is a

duplicate;, blue stamps "3e série", no coupons, VF: glue remains

in left upper corner, some tiny staple holes; very rare !, price 125 Euro.

Design of the shares and bonds (based on the book by Grigore (1997), see below):

The 21 by 40 cm light blue stock certificate was engraved by A. Stern, Paris,and printed by Société Anonyme de Publications Periodique - Imprimerie P. Mouillot, 13 Quai Voltaire, Paris, Their names are centered below the portrait of the certificate. But it is not known who designed the stock certificate. This portrait measures 117 mm x 167 mm from border to border and its thematic vignette reveals the Western Hemisphere in a partial globe of the world; two reclining bare-busted maidens allegorically depicting North and South America, clasping hands across a sea-level Panama Canal, with a ship exiting from the Cut; and a steamship in the lower corners. n the left and right columns is a telegraph pole, partially screened by palm fronds, on which there are affixed three banners listing countries of the world that would benefit from uniting the Atlantic and Pacific Ocenans via the Isthmus of Panama. Clasping the base of the left pole is a white and Asian child, implying the West's trade with the east. Atv the right pole is a white and black child, implying the West's trade with Africa. Telegraph poles support a large, single banner on which is cited the legal authority for the bond's issue, its capitalization, its title, intent, type, and serial number.

History (based on the book by Grigore (1997), see below):

Although the issue of the shares in 1880 was probably all with good and honest intentions, the entire undertaking ended up in the greatest engineering and financial disaster, followed by the worst political scandal, the world had ever known. It was an embarrassment to France. But, at the beginning of this undertaking Ferdinand de Lesseps, builder of the Suez canal (finished in 1869), which halved the journey time from Europe to the Indies, was the world’s most decorated and honored personage. He was compared to Columbus. In 1879 France was a rich nation and hubristic overconfident in what it could achieve, with its colonies, technological developments, science and art, boasting of luminaries such as Victor Hugo, de Lesseps, Pasteur, Eiffel and Sarah Bernhardt. Unfortunately the world’s largest commercial enterprise was fatally destined to become the most disastrous financial failure the world had ever seen.

The issue of the blue shares in 1880 is the only issue of shares in the company actually placed (an 1879 share issue was cancelled). Beyond that many bonds were issued.

The march 1888 bond issue was placed only to the extend of 25,7 %, even worse than the june 1888 bond (40,1%), but not as bad as the july 1889 lottery bond (13,1%), but that was after the company had ceased its operations. Only 89.890 bonds were placed in march 1888, by far the smallest number placed of all bond issues. Much less are available for collectors these days. It are rare pieces, really.

The company ceased operations on December 14th 1888. On february 4th 1889 the companies’ bankruptcy plea was accepted. The canal was less than 40% dug at a cost of an estimated 22.000 deaths and an expenditure of about $ 1,400,000,000 in today’s (1997) currency. It has been repeatedly reported that one third of this vast amount was spent on canal work, one third was wasted and one third was stolen.

It was the worst financial catastrophe ever suffered by the French people. As a consequence, the French Government’s prestige throughout the world was shattered.

In 1904 the United States Government purchaased all the assets and rights necessary for it to complete the Panama Canal, what they finally achieved in 1914.

Literature:

----- Grigore, Julius Jr. (1997), Stocks and Bonds Issued by the Compagnie Universelle du Canal Interocéanique de Panama, 1880-1889 and Compagnie Nouvelle du Canal de Panama, 1894, ISBN 0-9715805-1-0; W.G. Guy (publ.): Balboa, Panama, email: [email protected], price $70 + shipment., ca. 180 pages, ring bound, with many illusttrations in colour or black & white of stocks issued and a large variety of parafernalia. Warmly recommended !

----- Der Panamakanal wird 100, Technisches Weltwunder: BILDERSERIE: www.n-tv.de, 2014

La Holding Francaise & Holding de France: Oustric's business buble that finally bursted.....read the story (in Dutch) by the famous stock market speculator Kostolany.

These 2 companies show the same logo on their stocks, but I don't know the exact relation between the two. Who can inform me ?

|

|

Holding de France S.A.,

Action au porteur de 100 Fr, Paris 1931, with Dutch orange tax stamp,

with all coupons attached, measures without coupons ca. 32,5 x 20,5, no folds except at the coupon-sheet.

price €35 |

La Holding Francaise - H.O.L.F.R.A., S.A.

---------- Action ordinaire de Cent Francs au Porteur, Paris, 1928, red border on green field, with coupon sheet attached of which only one coupon has been cut. Measuring ca. 31 x 20,5 cm.

One year later the capital was -according to a stamp - raised from 25 million to 240 million Francs !

----------------- no. 213.879, price € 20

----------------- no. 387.734, price € 20

----------------- no. 213.878, price € 20

----------------- no. 249.480, price € 20

---------- Titre de 25 Actions Ordinaires de Cent Francs au Porteur, Paris, 1929, grey border on yellow field, with coupon sheet attached of which only one coupon has been cut. Measuring ca. 30,5 x 22 cm., Price € 50.

Literature:

Kostolany, Andé (1986), Kostolanys Börsenseminar Für Kapitalanleger und Spekulanten, uitg. Econ Taschenbuch Verlag, ISBN 3-612-26235-1

Kostolany, André (1986), Kostolanys Beurskroniek voor Beleggers en Speculanten, uitg. Strengholt, 1986, isbn 90-6010-657-1, 219 p.

La Holding Francaise: Kostolany &Oustric, V.V.O.F. Mededelingeblad Nr. 2 van juli-aug. 1980, blz. 9 en 10

The Netherlands

Chipshol Forward N.V.

Gev. te Hoofddorp (gemeente Haarlemmermeer); Bewijs van gewoon aandeel aan toonder, groot f 1; Hoofddorp 9-9-1991; zeer zeldzaam SPECIMEN uit de archieven van drukkerij De Bussy Ellerman Harms B.V., Amsterdam; conditie: fris van de drukker zonder enig gebrek, met aanhangend couponblad; blauw-groen bedrijfslogo; 6 facsimile handtekeningen, waaronder die van oprichter-directeur J. Poot sr. (Jan). prijs € 95.

Er zijn ook Bewijzen van f 10 en f 50 uitgegeven met respectievelijk de letters B en C.

Lees de geschiedenis van dit projectontwikkelingsbedrijf rond luchthaven Schiphol en hoe de droom van de succesvolle projectontwikkelaar Jan Poot, over de toekomst van Schiphol en omgeving, gedurende decennia van Machiavelliaanse intriges, grotendeels is opgegaan in een rook van processen, claims, rechterlijke dwalingen en uiteindelijk de opening van een justitiële beerput, die on-Nederlands lijkt, en die je, gelardeerd met pedosexuele affaires, doden en doodsbedreigingen jegens vele betrokkenen, eerder zou verwachten in een boek van Ludlum of Forsyth, dan in de Nederlandse praktijk. Maar helaas.....

NV Deposito- en Fondsenbank Amsterdam - DEFA, Amsterdam,

opgericht 1921. Tekst in Nederlands en Duits (Tekst auch in Deutsch)

Lees meer over de merkwaardige

gebeurtenissen ten tijde van het faillissement van deze bank.

----- 6% Obligatie, extra serie, f 1000, 23 mei 1966 tot 1978, , blauw,

see picture, UNC, ongevouwen, 45

Euro.

----- 5% kassa-obligatie, f 5000, 15-6-1966, met aanhangende coupons,

bruine sierrand op geel veld, see

picture, EF, 1 middenvouw, 55 Euro.

----- 5,5% kassa-obligatie f 10.000, 15-4-1966, met aanhangende

coupons, bruine sierrand op geel veld, picture as above, EF 1 vouw in

het midden, 59 Euro.

----- 5,5% kassa-obligatie f 50.000, met aanhangende coupons, 1966,

bruine sierrand op geel veld, picture as above, EF 1 vouw in het

midden, 68 Euro.

----- 6,5% kassa-obligatie f 100.000, 1966, bruine sierrand op geel

veld, picture as above, F: 2 maal doorgescheurd en weer met sellotape

geplakt, 90 Euro.

|

|

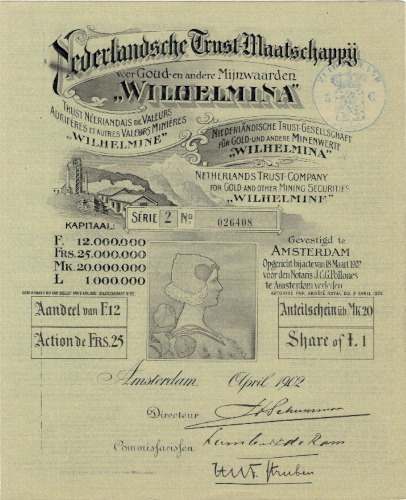

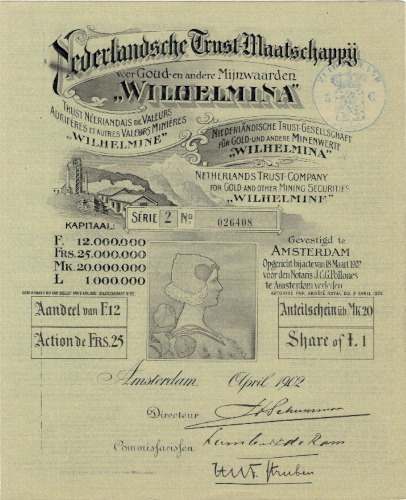

Nederlandsche Trust-Maatschappij voor Goud-en andere Mijnwaarden "Wilhelmina", Aandeel van F 12

Niederländische Trust-Gesellschaft für Gold- und Minenwerke "Wilhelmine", Anteilschein Mk 20

Trust Néerlandais de Valeurs aurifieres et autres Valeurs Minieres "Wilhelmine", Action de Frs 25

Netherlands Trust-company for Gold- and other Mining Securities

"Wilhelmina", Share of £ 1

Amsterdam, April 1902

Afm. 15,5 x 19 cm, met aanhangend couponblad en uittreksel der statuten.

Met o.a. een afbeelding van Koningin Wilhelmina met tulpen, Prijs € 100.

Wilhelmina van Oranje (1880-1962) |

Dit fraaie aandeel leek destijds veelbelovend. Toch was de beleggingsmaatschappij niets meer dan een brutale zwendel. De inschrijving stond open bij 39 bankiers en effectenhuizen in Nederland, 23 in België en bij huizen in Parijs, Londen, Berlijn en Wenen. De financiëel journalist en uitgever S.F.van Oss rook onraad en ontdekte dat de banken een vergoeding van tussen de 6,5% en 10% zouden opstrijken. In zijn blad De Nieuwe Financier en Kapitalist trok hij stevig van leer tegen de emissie. In de pennenstrijd die daarop volgde beschuldigde hij een van de betrokkenen, een man van naam en faam in de financiële wereld, ervan een leugenaar te zijn. Dit kwam van Oss op een geldboete van dreihonderd gulden te staan. De emissie flopte niettemin volledig. (bron Financieele Dagblad kalender augustus 2002, ontleend aan: S.F. van Oss, Vijftig jaren journalist, Den Haag, 1946).

Switserland

The IOS Investment Program Certificate

with respect to a certificate for the:

ITT = International Investment Trust Capital Accumulation Program

sponsor and distributor: Investors Overseas Services Ltd. (Bahamas)

with blue facsimile signatures of chairman of the board, the infamous,

Bernie Cornfield and of the treasurer, Norman P(?)alnick.; black

decorative border, vignette of an eagle, embossed IOS seal; issued in

Geneva (Switserland) in 1970; in liquidation since 1973; price 95

Euro.

USA

Ball 240 A = Criswell 122 B, "second series" 7% loan, February 20,

1863, second series; in witness whereof......March 2nd 1863; signature

of ..... Taylor; this is a counterfeit bond !

nos 2243 and 2233, 7 coupons left, small defect in left border, minor

brown stain in right upper corner, further very nice, 75 Euro.

Kreuger & Toll Company, 5% secured sinking fund gold debenditure

f $ 1000, New York, 1951, orange decorative border on orange

field, unfolded, several staple holes; 23 Euro.

Literature on scams and bubbles / Literatuur over beursschandalen en -zeepbellen.

Noordman, Th.B.J., en Wanderink Vinke, R. (1981), De soms schokkende maar altijd boeiende historie van het effect. Boekje (56 p. met gekleurde illustraties) samengesteld ter gelegenheid van het 100-jarig bestaan op 1 febr. 1981 van Theodoor Gillissen N.V.

Dit kleine maar fijne boekje behandelt de geschiedenis van het effectenwezen en ook diverse beruchte beurs-zeepbellen en schandalen. Warm aanbevolen voor verzamelaars van oude effecten en andere geïnteresseerden in financiële geschiedenis. Niet hier te koop.

You are here: home - scripophily

- scams

en Facebook of Linkedin